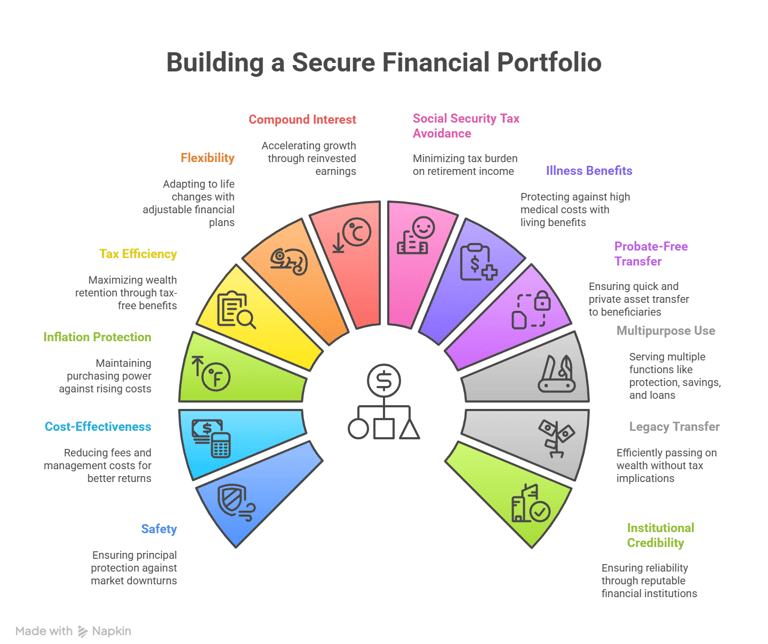

2. No Manager Required

Traditional investment portfolios often involve money managers or advisors, which can add fees and reduce your overall returns. Certain life insurance or annuity products grow on autopilot and don’t require constant oversight or management, making them easier and more cost-effective to maintain.

3. Not Affected by Inflation

Inflation can erode the purchasing power of your money over time. Some financial tools, such as IULs or inflation-adjusted annuities, are structured to keep pace with inflation by offering interest-crediting strategies tied to market indices, helping your assets grow in real terms.

4. Tax-Free Benefits

Tax efficiency is crucial. Products that offer tax-free growth, tax-free withdrawals, or tax-free death benefits, such as Roth IRAs or IULs, can significantly increase your wealth retention. They’re especially useful during retirement when every dollar counts.

5. Flexibility

Life changes—your portfolio should be able to adapt. Financial vehicles that offer flexibility in premium payments, withdrawals, or income timing provide you the freedom to adjust your plan as needed without penalties.

6. Compound Interest

The power of compounding is a cornerstone of wealth accumulation. Long-term financial products that reinvest earnings to generate their own earnings can accelerate growth significantly over time. Starting early can make a substantial difference due to this effect.

7. No Social Security Taxes

Some investment or retirement vehicles are structured to not count as "provisional income," meaning they don’t increase your Social Security tax burden. This feature can be critical in maximizing your retirement income.

8. Illness Benefits

Financial strategies that include living benefits—such as chronic, critical, or terminal illness riders—can help protect against high medical costs. These benefits allow access to a portion of your death benefit while you're still alive if you become seriously ill.

9. Probate-Free Transfer

Assets that avoid probate can be transferred directly to beneficiaries without court involvement, ensuring privacy, speed, and reduced legal expenses. Life insurance policies and annuities with named beneficiaries are examples of probate-free instruments.

10. Multipurpose Use & Liquidity

Your financial tools should serve more than one function. IULs, for instance, can offer protection, savings, and tax-advantaged loans. Liquidity—having access to your funds when needed—is also essential in emergencies or new opportunities.

11. Tax-Free Legacy Transfer

Passing on wealth should be efficient and tax-friendly. Life insurance is a powerful vehicle for tax-free wealth transfer, allowing your heirs to receive the full benefit without income tax implications.

12. Credibility of Institution

Lastly, always consider the financial strength and reputation of the issuing company. Look for carriers rated A or higher by agencies like AM Best or Moody’s. Credibility ensures they’ll be there when you need them.

By focusing on these features, you can create a financial portfolio that is secure, efficient, and built for both present needs and future goals.